All Categories

Featured

Table of Contents

This gives the plan proprietor reward options. Returns alternatives in the context of life insurance policy describe just how policyholders can choose to use the dividends created by their whole life insurance plans. Rewards are not guaranteed, however, Canada Life Which is the oldest life insurance firm in Canada, has actually not missed out on a dividend settlement since they first developed a whole life plan in the 1830's before Canada was also a nation! Below are the typical dividend choices offered:: With this option, the policyholder utilizes the returns to purchase additional paid-up life insurance policy coverage.

This is just recommended in the event where the death advantage is extremely crucial to the plan owner. The added price of insurance for the enhanced insurance coverage will decrease the cash money value, thus not ideal under boundless financial where money worth determines just how much one can obtain. It is very important to note that the availability of returns alternatives may vary depending upon the insurance provider and the certain policy.

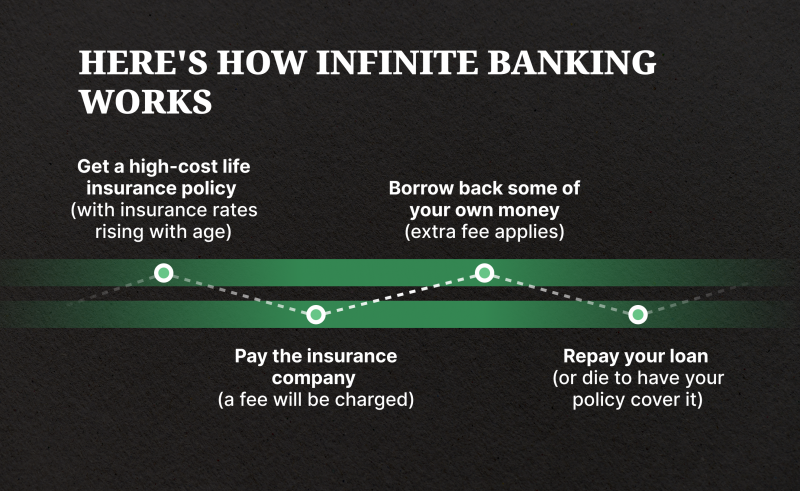

Although there are terrific benefits for unlimited financial, there are some things that you should consider prior to getting right into infinite banking. There are additionally some disadvantages to infinite financial and it may not appropriate for a person that is trying to find budget-friendly term life insurance policy, or if someone is considering acquiring life insurance entirely to safeguard their household in the occasion of their death.

It is necessary to comprehend both the benefits and restrictions of this monetary approach before deciding if it's best for you. Complexity: Infinite banking can be complicated, and it is essential to recognize the details of just how a whole life insurance policy policy works and how plan finances are structured. It is necessary to correctly set-up the life insurance plan to enhance boundless banking to its full possibility.

What makes Whole Life For Infinite Banking different from other wealth strategies?

This can be specifically troublesome for people that rely upon the survivor benefit to supply for their enjoyed ones (Infinite Banking retirement strategy). In general, unlimited financial can be a useful financial method for those who comprehend the details of exactly how it works and want to approve the costs and constraints linked with this financial investment

Select the "wealth" option as opposed to the "estate" alternative. Many companies have 2 different types of Whole Life strategies. Select the one with greater cash worths previously on. Throughout a number of years, you contribute a considerable amount of cash to the policy to develop the cash money value.

You're essentially offering cash to yourself, and you repay the car loan gradually, commonly with passion. As you repay the loan, the cash worth of the policy is replenished, enabling you to obtain against it again in the future. Upon fatality, the death advantage is reduced by any exceptional car loans, yet any type of remaining survivor benefit is paid tax-free to the recipients.

Can I use Cash Flow Banking for my business finances?

Time Horizon Risk: If the insurance policy holder determines to cancel the policy early, the cash money abandonment values may be substantially less than later years of the plan. It is recommended that when discovering this strategy that a person has a mid to long-term time perspective. Taxation: The policyholder might incur tax consequences on the financings, rewards, and survivor benefit payments obtained from the policy.

Intricacy: Infinite banking can be intricate, and it is essential to recognize the information of the plan and the money accumulation element prior to making any kind of investment choices. Infinite Financial in Canada is a legit financial approach, not a rip-off. Infinite Banking is a principle that was developed by Nelson Nash in the USA, and it has actually considering that been adjusted and applied by financial experts in Canada and various other countries.

Plan finances or withdrawals that do not exceed the adjusted cost basis of the plan are thought about to be tax-free. However, if plan financings or withdrawals surpass the modified expense basis, the excess amount may go through tax obligations. It is very important to note that the tax benefits of Infinite Financial might be subject to alter based upon changes to tax regulations and guidelines in Canada.

The dangers of Infinite Financial consist of the capacity for policy fundings to minimize the survivor benefit of the policy and the opportunity that the plan may not do as anticipated. Infinite Banking may not be the most effective strategy for every person. It is very important to very carefully think about the costs and possible returns of joining an Infinite Financial program, in addition to to extensively study and recognize the involved dangers.

How do interest rates affect Generational Wealth With Infinite Banking?

Infinite Financial is different from traditional banking because it permits the insurance holder to be their very own source of funding, instead than counting on standard financial institutions or loan providers. The policyholder can access the cash money value of the policy and use it to finance purchases or financial investments, without having to go via a traditional lender.

When most people need a loan, they use for a line of credit rating with a traditional bank and pay that funding back, over time, with passion. For doctors and various other high-income earners, this is possible to do with limitless banking.

Below's a monetary advisor's evaluation of infinite financial and all the advantages and disadvantages involved. Limitless banking is an individual financial strategy created by R. Nelson Nash. In his book Becoming Your Own Banker, Nash clarifies exactly how you can utilize a permanent life insurance coverage plan that constructs cash money worth and pays returns thus freeing yourself from having to borrow cash from loan providers and repay high-interest loans.

Is Infinite Banking Account Setup a better option than saving accounts?

And while not everyone gets on board with the idea, it has tested hundreds of hundreds of people to rethink exactly how they bank and how they take car loans. In between 2000 and 2008, Nash released 6 editions of the book. To this particular day, monetary experts ponder, technique, and debate the idea of limitless financial.

The infinite financial concept (or IBC) is a bit more complicated than that. The basis of the infinite banking idea begins with long-term life insurance policy. Infinite financial is not feasible with a term life insurance plan; you must have an irreversible cash money worth life insurance coverage policy. For the concept to function, you'll need among the following: an entire life insurance policy plan a global life insurance policy plan a variable global life insurance plan an indexed universal life insurance policy If you pay even more than the required month-to-month costs with irreversible life insurance policy, the excess contributions accumulate cash value in a money account. Cash flow banking.

However with a dividend-paying life insurance coverage policy, you can expand your cash worth also quicker. Something that makes whole life insurance policy one-of-a-kind is earning even more money with rewards. Suppose you have an irreversible life insurance plan with a mutual insurance provider. In that situation, you will certainly be eligible to get component of the business's revenues similar to exactly how stockholders in the business get rewards.

Table of Contents

Latest Posts

Bank On Yourself Complaints

Wealth Nation Infinite Banking

Banking On Yourself

More

Latest Posts

Bank On Yourself Complaints

Wealth Nation Infinite Banking

Banking On Yourself